When looking to build a long-term portfolio of stocks that pay high dividends, investors usually come up with a mix of stocks that either have high dividend yields or high dividend growth rates. It is difficult to find good companies that have both. This means that there is often a choice to be made. All else equal, should one invest in the company that has that enticing high dividend yield, but a low dividend growth rate, or does one exude patience and invest in the company with a relatively low yield, but a high dividend growth rate? To help answer this question I looked at two companies that offer these different alternatives: AT&T (T) and Johnson & Johnson (JNJ).

| T: | | Div Yield | 1 Yr Div

Growth Rate | 5 Yr Div

Growth Rate | | | 5.4% | 2.4% | 4.8% | | | | | JNJ: | | Div Yield | 1 Yr Div

Growth Rate | 5 Yr Div

Growth Rate | | | 3.5% | 7.0% | 9.4% | | |

There are clear differences in the two companies’ dividend yields as well as the growth rates. This presents a great case study in which company will give the investor a better return due to dividends over time. More specifically, I want to measure the Yield on Cost (YOC) and how it changes over time as well as the compounded annual return due to dividends. The YOC simply measures the annual dividend divided by the original investment in the company’s stock.

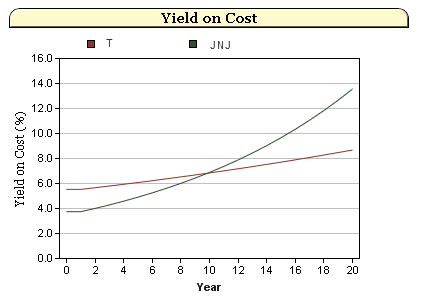

I ran the following analysis in our free calculator called Dividend Yield And Growth. Starting with the simplified assumption that the growth rate of each dividend follows the one year growth rate, we see the following:

It takes 10 years for the YOC for Johnson & Johnson to break even with the YOC for AT&T. Of course, due to compounding we see the YOC for Johnson & Johnson explode upward eventually. But this assumes that the company can continue its relatively high rate of dividend growth going forward.

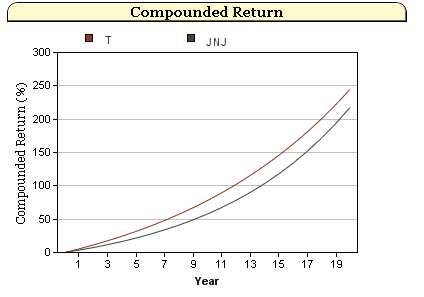

Even more important than the YOC is the compounded total return over time. Even if we assume that Johnson & Johnson’s dividend growth rate continues at this high rate, the compounded return for this stock will never break even with AT&T over a 20 year time frame. It is also important to note that I do not consider any price appreciation in these calculations and compounded returns are due solely to dividends.

In this scenario AT&T is the better investment since it has a higher return over the 20 year time frame. Their higher dividend yield beats out Johnson & Johnson’s higher growth rate.

Of course, there are many who feel that there is no way AT&T can keep up even a relatively low 2.4% growth rate in their dividend due to fierce competition in their industry. So what if their dividend growth rate is cut in half? Running this scenario I found that AT&T would still return 6% per year for 20 years while Johnson & Johnson would also return 6%. Their compounded returns would break even in 7 years.

Basically AT&T is a fantastic investment for a retirement portfolio if they can keep their strong dividend yield of 5.7% and eek out dividend growth above 2%. Even if growth in their dividend is miniscule, the yield alone will give investors a solid return for many years. I am also a strong believer in Johnson & Johnson, a company which has shown remarkably consistent dividend growth over decades.

Lastly, I have found by plugging in various dividend yields into our retirement planner that finding dividend payers who can return just 2% more than bonds or other dividend payers can increase the time that funds last in retirement by more than a decade. The key is finding companies who will either pay a strong dividend or have serious dividend growth and have shown a culture of not cutting dividends when times get tough.