Can I retire by the time I'm 60? I hear that question a lot in my line of work. Although for some people retiring before age 60 is impossible, many others can still legitimately ask this question.

So what does it really take for most people to retire by the time they turn 60? If you have a gigantic pension coming your way, that certainly helps. But I want to focus on people that don't have a pension and must use their own savings combined with social security.

Let’s look at a couple who is 50 years old. They want to figure out if they can retire by age 60. They currently have $500,000 saved. Half of their money is in taxable accounts and half is in IRAs. I assumed that 70% of their money is invested in value stocks and the rest is in medium-term treasury bonds. They save $10,000 a year, they will receive a combined $45,000 in social security payments when they reach age 67, and their plan is to spend $55,000 a year in retirement. I have assumed 2.5% inflation per year, 6% returns on equities per year, and 2.5% returns on their treasury bonds per year. Here are my assumptions summarized:

| Inflation (CPI) | 2.5% |

| Current Age of Both People | 50 |

| Age Of Retirement | 59 |

| Age When Both People Have Passed Away | 90 |

| Social Security at age 67 (combined) | $45,000 per year |

| Average Savings Rate | $10,000 per year |

| Total Investment Balance Today | $500,000 |

| Recurring Annual Expenses in Retirement | $55,000 |

| Investment Mix | 70% U.S. Value Stocks, 30% Medium Term Treasuries |

| Investment Location | 50% in taxable accounts, 50% in IRAs |

| Return Assumption Value Stocks | 6% per year |

| Standard Deviation Value Stocks | 16.20% |

| Return Assumption Treasuries | 2.5% per year |

| Standard Deviation Treasuries | 7.20% |

I placed these assumptions into our financial planning software built for individuals, which is available to the public, and found that this couple would have about $700,000 when they retire and that they will never run out of money. This was the static case where rates of return are constant. When running a Monte Carlo analysis that generates one thousand simulations where investment returns change every year, I found that they only have a 60% probability of never running out of money.

A probability of 60% is not good enough for most people. Let's say this couple would like to see a probability of success above 80%. How can they get there? I ran some scenarios in our financial planning software and came up with at least three ways they can increase their chances of retirement success: They can postpone retirement for two years, they can contribution $2,500 more per year to their investments, or they can decrease spending by $5,000 per year.

But the goal is to retire by age 60, so the first idea won't work for them. Also, saving more is not an option for many people as they’re already struggling to make ends meet. Lastly, spending $55,000 in retirement is pretty frugal as it is, so this couple doesn’t want to do that either.

A big part of this couple's problem is that their income in retirement is not enough to meet their spending goals. One issue is that 30% of their funds are in low-yielding treasury bonds. But what if we were to move them into high quality dividend paying stocks that generate closer to 4% per year in dividend returns (which includes dividend yield and dividend growth) and 2% in price appreciation? A few of my favorite dividend payers for retirement portfolios that have a dividend yield of 2.5% or higher are Johnson & Johnson (JNJ), Exxon (XOM), Merck (MRK), AT&T (T), and Phillip Morris (MO).

| Company | Dividend Yield | 5 Year Dividend

Growth Rate |

| JNJ | 2.9% | 6.9% |

| XOM | 3.8% | 10.2% |

| MRK | 3.6% | 3.0% |

| T | 5.3% | 2.2% |

| MO | 3.7% | 8.7% |

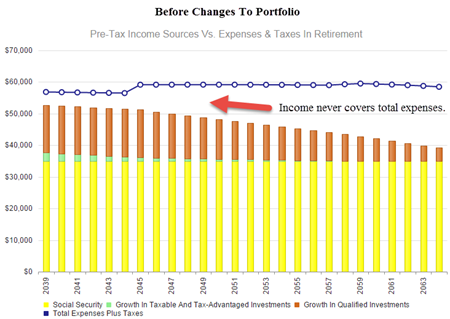

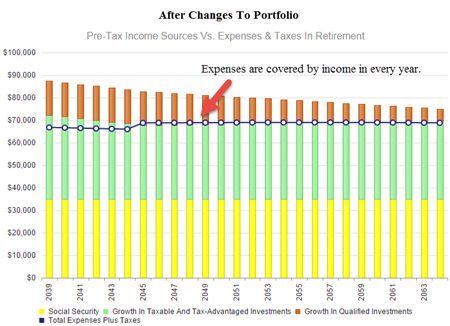

In this couple's portfolio I substituted the above stocks for their treasuries and ran the analysis again in our financial planning software. Now their income stream is much higher as you can see in the before and after charts below.

With all of this extra dividend income now covering expenses, the probability of them never running out of money, even if they retire at age 59, is 87%. This is a very comfortable spot to be in.

One issue with this change of course is that equities are more volatile than treasuries. But if we find companies with a history of paying strong and growing dividends through time, price movements are not nearly as important as those dividends coming in each quarter.

I usually get at least one person asking the question, "But what if I don't have $500,000 saved already!" Let's look at an example where a couple is 50 years old, but only has $250,000 saved. The question is, when can they retire and have a probability of success of at least 80% (assuming they move to the dividend-growth strategy).

I ran these numbers and found that this couple would have to wait until age 65 to retire comfortably.

Each person and couple has a different situation and might need to change a variety of things in order to retire earlier. But it is usually impossible to tell whether or not you can retire when you want until you sit down and actually run through the numbers in a legitimate financial planning software package. At that point you can begin running interesting scenarios that will tell you what you need to do to get to your goals.

Can you retire by the time you are 60? WealthTrace can help you find out. See how making small changes to savings can have a big effect on the probability of your plan succeeding. Use a free trial of WealthTrace to find out more.