Key Points

- Early retirement comes down to prioritizing levels of spending, saving, and investing, as well as choosing where to invest.

- You can predict and model these things with reasonable accuracy if you use the proper tools.

If you have ever worked with a contractor, or at least a contractor who is being up front with you, you may have heard something like the following: "You can have the work done cheaply, quickly, and of very high quality--but you can only pick two of these things."

There are parallels here to retiring at 60, or some other early age. You can retire early; save and invest a reasonable amount of money for someone your age; and spend freely. But you may only be able to pick two of these things.

Let's Meet Our Contestant

Julie Barrington is 43 years old and starting to think about retiring--and even retiring early. She is targeting age 60 as the age at which she would like to retire.

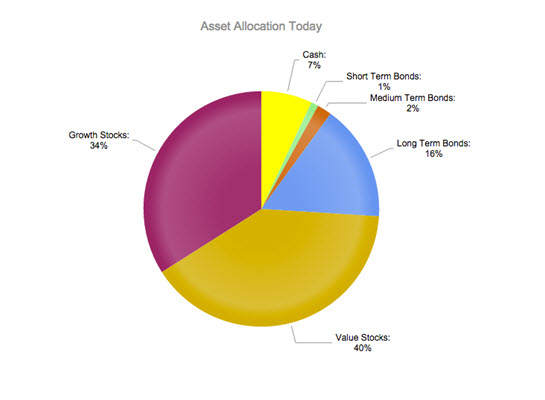

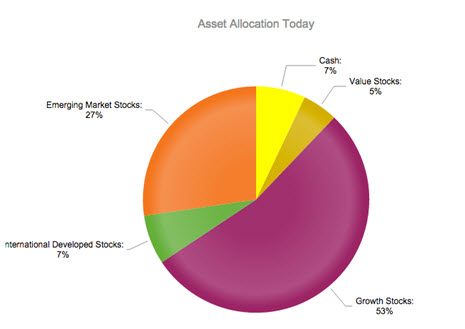

Julie has an assortment of invested assets. She has been diligent about contributing to her 401(k), and it now has a balance of $270,000. She has a few taxable accounts as well. Most of her investments are in stocks, but the portfolio leans to the conservative side.

Julie's portfolio has a healthy amount in stocks, but most of those stocks (as value stocks) are fairly conservative investments.

Julie also owns a business that she believes she'll be able to sell for $370,000 when she is 60. She plans on continuing to work part time for a few years after retiring from full-time work--perhaps even at her business after she sells it, as a consultant.

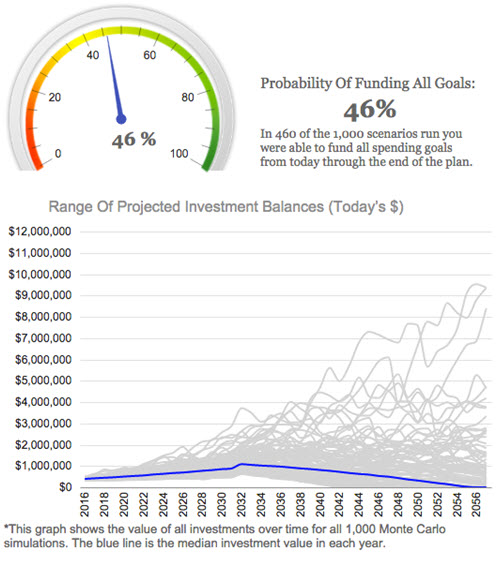

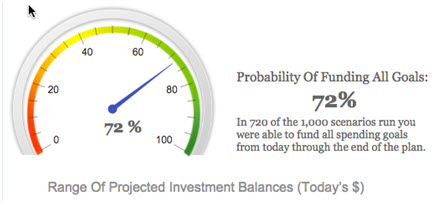

Let's run Julie's financial situation through the WealthTrace Retirement Planner's Monte Carlo simulation to see how things look. (See our Using An Accurate Monte Carlo Retirement Calculator article for more information about Monte Carlo simulations.)

A less-than-50% probability of funding all of one's retirement goals is not the result anybody wants to see. What's going on here?

Not a Gut Rehab, Just A Remodel

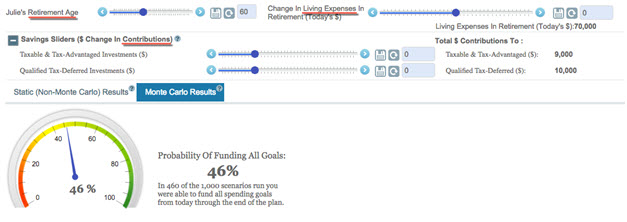

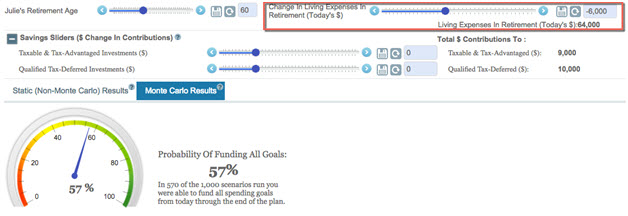

It looks like we'll need to make some changes. Remember at the beginning of our article, we said you can retire early; save and invest a reasonable amount of money for someone your age; and spend freely--but that you may only pick two of these things. In WealthTrace, you can make changes to all three of these factors (and others) right on the screen, and see how those changes could affect a plan if they were implemented.

Make changes to various parts of your plan (such as those underlined above) to see what effect they might have.

In Julie's case, we'll start by reducing her living expenses in retirement. She has entered $77,000 because it's about what she spends on living expenses now. But a lot of people spend less during retirement than they do before retirement

Now we're getting somewhere. Reducing Julie's spending in retirement by $7,000 annually pushes the needle into the green, though not far enough for comfort.

What about the age of retirement? She would like to retire at 60, but what happens if that age gets pushed out by two years, along with the above-mentioned reduction in spending?

That extra two years makes a big difference to Julie's probability of funding all of her retirement goals.

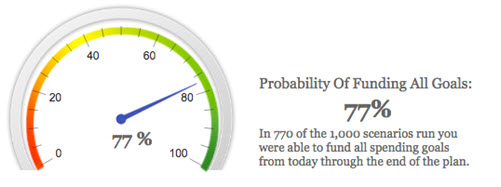

Julie is already doing very well with her rate of savings--probably above average. But what about her asset allocation? Investing in stocks is definitely the way to go for someone in their 40s, but ramping up the more aggressive assets (rather than that big slug of value stocks) might help get her to early retirement more quickly.

Getting more aggressive with the stock investments adds a few more percentage points.

On Time And Under Budget

Our comparison to the work a contractor does might be a bit of a stretch. You might be able to achieve all three of these things. (And, for that matter, you might be able to find a contractor who can do cheap, quick, and high quality!) But compromise of some sort is normally necessary to get to early retirement. You may not be willing or able to do all of these things (or "pull all of these levers," as we put it in another article on the topic) to get to early retirement. But knowing what your options are to get there, and what effect small changes can have, is the first step.

What is the probability that you can retire early? WealthTrace can tell you. Sign up for a free trial of WealthTrace today.