It is not easy these days to find companies that pay a dividend yield of nearly 5%, have never cut their dividend in over 40 years, and who continue to increase the dividend at a nearly 10% rate. But there is one such company out there. Altria (MO), parent company of Phillip Morris, continues to pay out its steady dividend, even during recessions, making it a wonderful addition to retirement portfolios.

What I want to look at in this article is how a company like Altria can change (and potentially save) a retirement portfolio. I want to show what the dividends alone can potentially achieve over a long time horizon. Altria's current dividend yield is 4.8% and their dividend grew by over 9% in the past year. Over the past five years their dividends have grown by an annual rate of over 9% as well.

I want to take a look at a 45 year old couple that has been scared out of the stock market and currently has everything invested in long-term treasury bonds yielding 3%. They currently have $400,000 saved and are saving $10,000 per year. Let’s also apply an inflation rate of 2% for each year. They plan on retiring when they are 65. How much money can they expect to have when they retire if we take into account inflation? For this example I assumed half of their money was in a qualified, non-taxable account such as an IRA. They pay taxes at a 30% rate on their investment income and dividends are taxed at a 15% rate. They plan on spending $50,000 per year in retirement. Lastly, they expect to receive combined social security payments of $35,000 per year when they are 67.

Here are the results for this couple if they keep all of their money invested in low-yielding treasuries:

| Beginning Value

Of Account | Value

Of Account At Retirement (Nominal $) | Value

Of Account At Retirement (Real $) | Real Annual Return After Taxes |

| $500,000 | $757,678 | $556,775 | 0.54% |

In 20 years their investments have only grown by a mere $56,775 if we reduce everything by the inflation rate. That is only 0.54% per year in real terms. I plugged in these numbers into our Retirement Planner and found that this couple would only have a 15% chance of not running out of money if they save $10,000 a year for the next 20 years, spend $50,000 a year in retirement and receive $35,000 a year in social security payments. This couple is headed for serious trouble.

Now let’s look at the case where they invest half of their money in a basket of dividend paying stocks like Altria. It is important to note that I am not recommending investing in just one stock. I am recommending investing in a basket of solid dividend paying stocks that are projected to pay growing dividends for a long period of time.

In this example I assumed a dividend yield of 4.8%, long-term dividend growth of 7%, and no increase in the stock price at all. I ran these numbers in our free online calculator called Dividend Yield And Growth.

| Beginning Value

Of Account | Ending Value

Of Account (Nominal $) | Ending Value

Of Account (Real $) | Real Annual Return After Taxes |

| $500,000 | $1,309,000 | $880,700 | 2.9% |

Now we’re talking some real money when they retire. They will have over $885,000 (in today’s dollar terms) when they retire. Plugging these numbers into our Retirement Planner I found that they now have a 90% chance of never running out of money in retirement. It is important to keep in mind that I assumed no change in the stock price in this example. I wanted to show how just collecting the dividends from strong dividend growth stocks can have such a large impact.

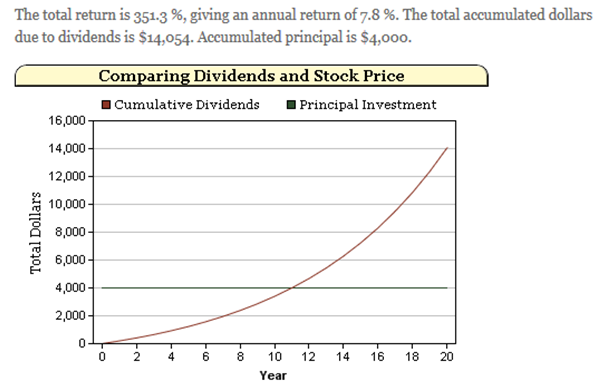

In fact, with a company like Altria, where we expect them to increase their dividend at a reasonable rate for years to come, the change in the stock price becomes nearly meaningless. If you invested in 100 shares of Altria today, the dividend growth rate is 7% per year, and their stock price doesn't move, we see the following over 20 years:

Notice how the dividend payments eventually swamp the initial investment. In fact, the stock price could fall by 50% over this time frame and the investor would still see an annual rate of return of 7%.

Given enough time, a company like Altria can completely change the retirement picture for an investor. Of course, this assumes that they will continue to increase their dividend payments over time. But if history is any guide, companies like Altria will indeed reward shareholders with large increases in dividends. They have shown that they have the ability and willingness to reward shareholders with a steady increase in dividend payments even during recessions.