It is never too early to start thinking about how you might prepare for your retirement years. Unfortunately, many people don’t really sit down and go through any sort of analysis until they’re in their 50s or even later. For those who would like to plan ahead, there are multiple ways to help set yourself up for a secure retirement later. There are also traps that many fall into: Here are three of them to avoid.

Don’t begin saving too late: Too many people think they can always save later for retirement. They think that they can spend freely today and then later on when they make more money they will be able to save more. But saving money becomes a habit, and unfortunately not saving money (and spending too much), also becomes a habit as well. It is best to develop a culture of saving and living below one’s means early on in life. In addition to developing this beneficial habit, you will reap the rewards of compounded returns over time. Let’s look at a 25 year old who thinks he might retire when he’s 65. I looked at how saving more today will impact his final portfolio by using our publicly available calculator called Savings From Spending Less. I assumed a real rate of return of 3% per year, a federal tax rate of 25%, and a state tax rate of 5% on all investment gains. I came up with the results below:

| Extra Savings Per Month ($) | Additional Portfolio Value

in 40 Years Due to Saving More |

| 100 | $75,404 |

| 150 | $113,106 |

| 200 | $150,808 |

| 250 | $188,510 |

| 300 | $226,212 |

| 350 | $263,914 |

| 400 | $301,615 |

It is important to note that all dollar values are in today’s dollars. In other words, they’re already adjusted for inflation. Amazingly, by saving just $200 more per month at an early age, this person will have over $150,000 more in his portfolio when he retires.

Don’t count on getting 100% of your social security benefits: I hate to frighten people about this often brought up topic. For those who are in their 50s or older, you most likely will see all of the social security payments coming to you. But for those of us who won’t retire for 20 years or later, there are major clouds on the horizon when it comes to social security.

The social security “trust fund” was barely a trust fund to begin with as it has been raided over the years to pay for all sorts of federal projects. But now with the social security payroll tax being cut for employees by 2%, it is nearly guaranteed that that there won’t be enough money to pay full benefits. It is estimated by the Social Security and Medicare Board of Trustees that the Social Security fund will not be able to cover full benefits starting in 2036. And this estimate was made before the 2% cut in the employee payroll tax. They also estimated that in order to maintain the fund, benefits would have to be cut by 25% starting in 2036.

So how much would it impact the typical retirement plan if social security payments are cut by 25%? I ran this scenario in our retirement planner and found the following: A couple that receives a combined $30,000 per year in social security benefits will run out of money 12 years earlier if their benefits are cut by 25%. This is a drastic change in circumstances for this couple and means they need to come up with a way to offset this problem.

The bottom line is that those of us who will likely see our benefits cut should include a haircut for social security payments when planning our retirement. That way we won’t be surprised later on and we can take measures today to help make up for this lost income.

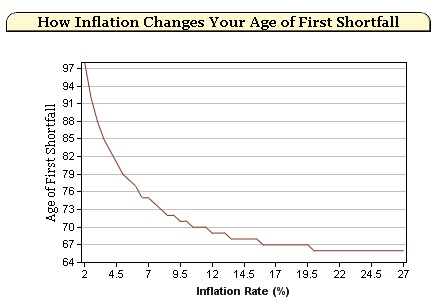

Make sure you are beating inflation: I’ve written before about how important it is to beat inflation in your portfolio. An investor who has all of his money in fixed income earning, say 1%, is losing money every day to the rate of inflation being higher than his total return. Let’s assume an inflation rate of 2% for the next 20 years. I ran the following in our inflation retirement calculator: A 45 year old who has $500,000 saved for retirement today and is earning only 1% on his investments can push out the year when he runs out of money by 4 years if he simply matches inflation over the next 20 years. If he can actually beat inflation by 1%, he will push out the year when he runs out of money in retirement by 9 years.

Let’s start the new year of 2012 off right by avoiding the three pitfalls I’ve talked about today. You’ll be much better prepared for retirement if you do.