The power of growing dividends over time continues to be underestimated by many investors. Many are concerned with another decade of slow growth and low to negative equity returns. However, one way to prepare for another decade of slow economic growth is to invest in dividend paying stocks that have shown they can weather tough economic times and even increase their dividends while it happens.

One such company is Wal-Mart (WMT). Although their dividend yield has fallen to 2.2% (due to a nice run-up in their stock price) Wal-Mart is still one of my favorite dividend paying stocks as they continue to increase their dividend payments at a healthy rate.

| Wal-Mart: |

| Div Yield | 1 Yr Div

Growth Rate | Annualized 3 Yr Div

Growth Rate |

| 2.2% | 9.0% | 15.2% |

| Annualized 5 Yr Div

Growth Rate | Payout Ratio | Last Year in Which

Div Did Not Increase |

| 16.2% | 32.0% | 1981 |

Wal-Mart has a solid history of growing dividends over time. The last year in which the company did not increase its dividend was 1981. The growth rate of the dividend over the past 5 years has also been stellar at over 16%, although it has slowed to 9% in the last year.

It is not necessarily obvious how investors will fare if they hold onto Wal-Mart for the next 10 years, receiving not only the dividend, but a growing dividend over time. It’s important to analyze scenarios for such a company where we look at the dividend yield and growing dividends.

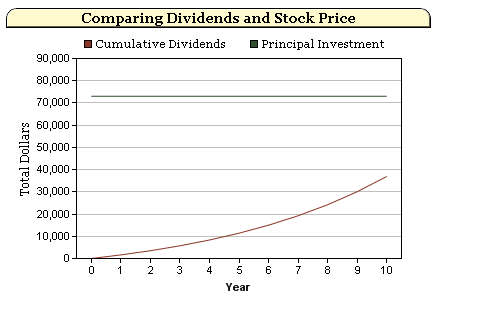

I ran the following scenario on our publicly available calculator called Total Returns- Dividends vs. Price Appreciation. If we buy 1000 shares today, apply the 3 year growth rate of 15% over the next 10 years, reinvest dividends, and assume the price of the stock does not change, we get the following:

| Inputs: |

| Investment | Dividend Yield | Growth of

Dividend (Annual) |

| $73,000 | 2.20% | 15% |

| Outputs: |

| Total Return | Annual Return | FV Dividends | FV Investment |

| 51% | 4.2% | $36,912 | $73,000 |

An annual return of over 4.2% when the stock price hasn’t moved is definitely a victory. I also included the future value of the dividend income stream compared to the future value of the initial investment. The dividends accumulated to more than $36,000 over the 10 year period. Looked at another way, the price of this stock could fall by 50% during this period and the investor would still break even. Now let’s take a look at what happens over 20 years using a more conservative dividend growth assumption of 9%.

| Total Return | Annual Return | FV Dividends | FV Investment |

| 148% | 4.6% | $107,939 | $73,000 |

The annual return jumps to 4.6% even with no growth in the stock price. Again, the key here is the growing dividend payments over time. That is the beauty of high dividend paying stocks over time. The initial investment becomes less and less important.

Dividend growth stocks can help a retirement plan immensely, especially vs. low-yielding treasury bonds. I plugged in the 4.2% total return figure I found in our first example into our retirement planner in place of the ten treasury bonds that were in the portfolio before.

I found that if a typical 55 year old couple with $400,000 in assets, with half invested in treasuries, moves 50% of their funds from treasuries to dividend payers that give them a 4.2% return, over ten years they will have increased the time that their funds last in retirement by over 9 years.

I believe that investing in Wal-Mart today for the long run will pay off due to their consistent and growing dividends. Scenarios such as the ones I’ve run here can help investors understand the power of dividends over time, especially when those dividends are growing.