Key Points

- We looked at a popular blog site where the creator retired at age 33.

- We took his actual information and ran his retirement plan in WealthTrace.

- Can this family of five really retire so early?

Meet the RoGs

We recently wrote an article about the FIRE (Financial Independence, Retire Early) movement. In this piece, we want to take a look at one of its best-known practitioners, Root of Good (or RoG for short).

This is a family of five in North Carolina. The couple are in their late thirties and have effectively stopped working full time--and plan to keep it that way. They earn income from their web site and a few other sources, but it’s nothing like the 9-to-5 office-job money they used to make. In typical FIRE fashion, they worked hard at high-paying jobs for a short period of time (about 10 years), saving a huge portion of their income, and then . . . stopped. And started blogging about it and attracting media attention.

Mr. RoG has done the occasional case study of early retirees on his blog. We’re going to do one of his family using information he has generously published about his financial life. We may not have all of the details exactly correct, but he has given us a lot to work with (such as monthly financial updates), so we should be able to be reasonably accurate in our assumptions.

Investments

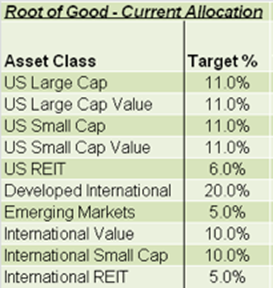

The RoGs have done a lot of the right things when it comes to investments. They take an asset-allocation approach to investing, and have moved everything to Fidelity and Vanguard and kept their fees low. Bravo. They also rebalance their assets on a regular basis (which is something WealthTrace can model). Based on information from various locations on the RoG web site, we estimate their investment account balances to be about $1.7 million (as of November 30th).

Source: Root Of Good

WealthTrace uses asset allocations when running its projections, but it doesn’t get quite as granular as what’s listed above with its default asset class assumptions. So, for the purposes of our case study (and for running Monte Carlo simulations), we have mapped RoG’s asset allocation to WealthTrace's.

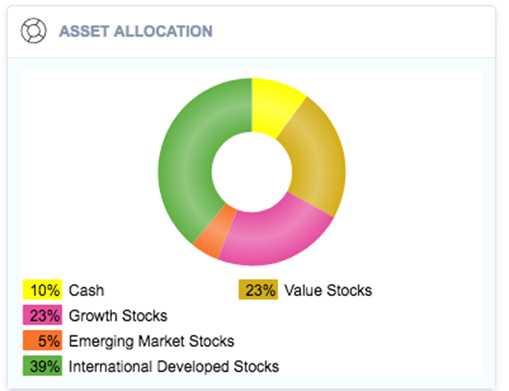

Based on the information given above, comments made on their blog, and some assumptions on our part, our assessment of their asset allocation as WealthTrace knows it looks like this:

For these asset classes, we'll use the following nominal annual asset class return assumptions:

Value Stocks 5%

Growth Stocks 7%

International Developed Stocks 7%

Emerging Market Stocks 7%

Cash 1.8%

By most measures, these are pretty conservative total return assumptions. If we want, we can increase them (or decrease them, if we want to be really conservative).

During the last recession, rather than panic selling, RoG actually moved to a more aggressive asset allocation. This was a fortuitous decision in hindsight, obviously. It took guts--and some good fortune as well.

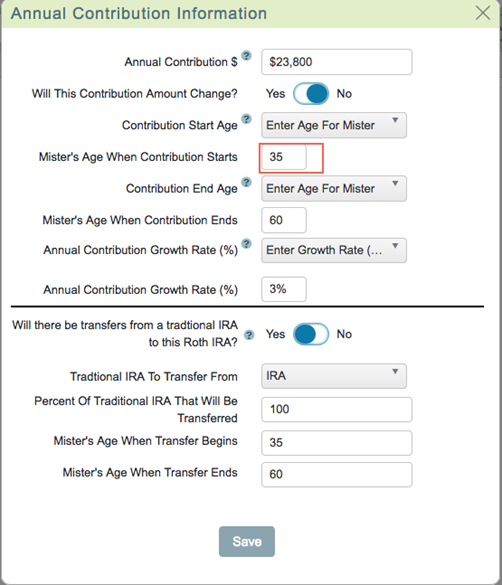

Getting a handle on laws and regulations that are fairly obscure to most people can be especially important for early retirees. The RoG family is on top of many of these rules, and are using some of them to their advantage--like Roth IRA conversion laddering.

WealthTrace is able to model a traditional-to-Roth IRA conversion and the taxes (up front, rather than deferred) that result. RoG doesn't plan to tap into their Roth until 2025, and we're able to model that too (on a different screen not shown here).

They have a few tax-deferred and tax-advantaged accounts, such as 529 plans for the kids. The RoGs no longer fund those 529 plans. You can read about their thinking on that here, but essentially, they are confident that they'll have college covered when the time comes.

Health Insurance

The cost of health insurance is a big question for a lot of traditional retirees--possibly the biggest question they will face. It's very difficult to predict with any reasonable degree of certainty what our healthcare needs will be down the road. And even if you could predict certain events or expenses ("I'll need a hip replacement when I'm 68"), you really can't estimate what it might cost more than a few years out.

As the rules stand now, this family of five qualifies for serious subsidies due to their low income. That’s because, when looking at what subsidies a family qualifies for, the Affordable Care Act (ACA) only looks at income, not assets. Because they live on such a relatively small amount of money, the RoGs only pay about $500 per year for health insurance--for the whole family.

Mr. RoG will tell you about it here. There’s definitely some strategy to making this happen. Most people aren’t in this boat; if they have low adjusted gross income, they generally have low assets too. But these FIRE types are a different breed.

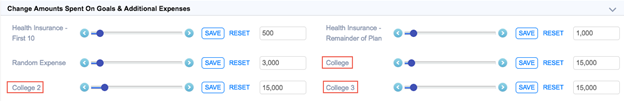

What will health care costs look like over the next 50 years? Will the ACA survive in anything close to its current form? Your guess is as good as ours. For RoG, we have assumed a 5% increase per year for the first 10 years, a jump to $1,000 a year at that point, and then keeping up with inflation after that.

We would not normally enter health insurance as two separate items, but it makes sense to do so here given the length of time ahead. Even so, we don't have any great sense of what health insurance bought through the health exchanges will cost over time, or if those exchanges will continue to exist. Health insurance still could be something of a wildcard expense for the RoGs.

Social Security

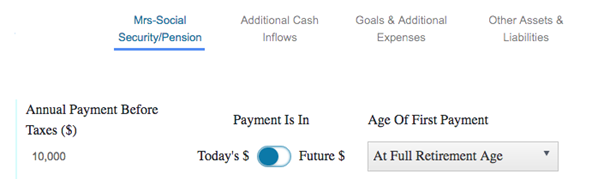

The RoGs have done the math and figure they will be looking at $24,000 a year in Social Security benefits when the time comes.

They have a long way to go before they start thinking about Social Security. They're pretty confident that it will be there for them. But there are those who believe the program could be in some trouble by the time it appears on the RoGs' horizon, and that benefits may be cut. Just to be conservative, we've reduced their projected benefits to $20,000.

Spending

A lot of people might look at the RoGs' budget and wonder how they even get by, let alone how they have retired. This is a family of five living comfortably on $40,000 per year, or even substantially less some years. What's their secret?

They paid off the last of their mortgage a few years ago. Obviously this is a big deal for a family not living on much money, as a mortgage is a big fixed expense for most homeowners. But the RoGs are also frugal, have just one car they bought used and on which they carry high-deductible insurance, do a lot of cooking themselves, and don't buy what they don't need.

They do like to travel, and put a substantial amount of spending toward that. They also get a lot more value out of their travel dollars because they leverage credit card sign-up bonuses and Airbnb credits to their advantage.

Amazingly, as much as a third of what might seem like a budget with no room for error is discretionary spending, by their reckoning. That is, it's up to them whether they'll spend it or not, and it would be relatively easy to cut back on if necessary, as opposed to utility bills and food and basic everyday expenses. A key part of their plan is to cut back when times call for it, such as if a recession were to hit.

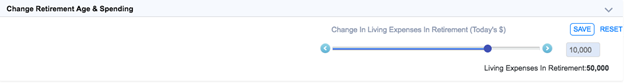

In our case study, we have assumed $40,000 annually in living expenses each year (even though they have come in under that number in recent years), growing right with inflation.

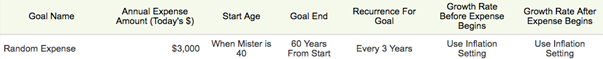

Unexpected Expenses

RoG takes the approach of averaging somewhat expected but irregular costs out over a number of years as part of that above-mentioned living expense number. That's a smart way to go. In our WealthTrace plan for them, we added an unexpected expense of $3,000 every three years just to be extra safe: A heating system fails, a big medical or dental expense materializes out of nowhere, a new used car is needed. They do have a big cash cushion, and that's great, as it means they would be able to weather an unexpected expense a lot better than most people.

Income

They like dividends; we like dividends too. Because their income is so low, all of their qualified dividend income will be tax free (and RoG has practically made a hobby out of paying no federal income taxes). In 2015, taxable-account dividends covered a third of their living expenses.

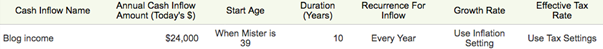

Investment income in general covers much of what they live on, but RoG also brings in a substantial amount from the blog. We have accounted for that income for the next ten years and assume (conservatively, we hope) that it disappears after that.

So How Does The Plan Look?

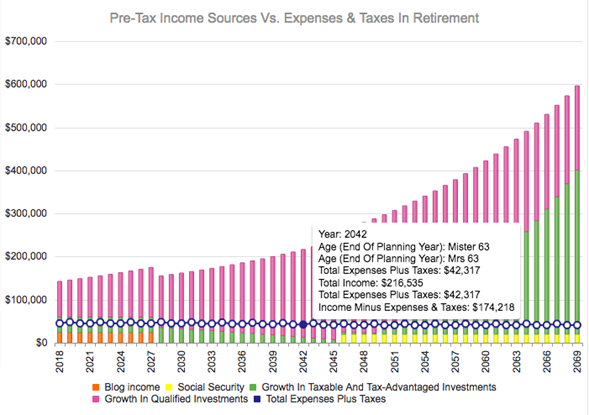

In WealthTrace, there are two ways to look at a plan.

The first way is on a straight-line basis--meaning we assume steady total returns, year in and year out. Things look pretty good for the RoGs with this method. We don't see them running out of money, and they could even have a pretty massive stockpile at the end of their lives.

This is useful information, but it's not something we want to count on without question. The problem with straight-line assumptions is that life--and the stock market--are anything but straight-line. Barriers and bumps appear at random.

If this were a more traditional plan, with 25 or so years ahead of them before they retire, we might be more comfortable banking on the numbers, as over time the bumps should smooth out. But the RoGs are retired now, and thus need the income from their investments now; a series of bad bumps (in the form of unexpected expenses and/or bear markets) could do real damage that won't be reflected in this way of looking at things.

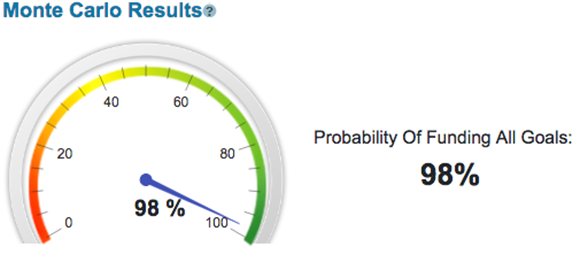

To add some randomization, we also like to look at plans on a Monte Carlo basis. And once we start running their plan through a Monte Carlo simulation, well, it still looks pretty good.

In fact, even if we boost the assumed annual spending to $50,000 per year, they're still above a 90% probability of funding all of their goals. Impressive.

Or, instead of increasing their assumed living expenses, they could easily add a few years' worth of college expenses to the program--an annual expense for each kid, for four years each at the appropriate time--and see how that might work out for them:

The Bear Market Scenario

The RoGs are smart, informed, and have done a lot of work to get to where they are financially. They are confident that they can make this work, and that they'll be able to handle any curveballs (like the above-mentioned college expenses) that come their way.

But let's use WealthTrace to throw them a curveball nonetheless.

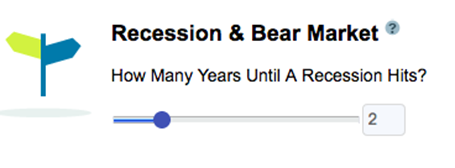

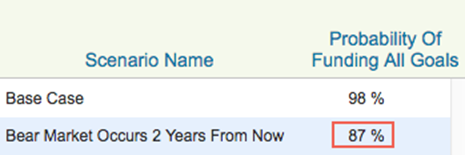

Putting the plan through a bear-market scenario is a real stress tester. What we do here is assume 2007-2009-like total returns for a year, and then calculate the probability of success of a plan after a year of those returns.

In RoG's case, we're basically assuming the value of the portfolio gets cut in half two years from now. That's because the assets they are largely invested in--stocks of many flavors--lost about that much in value during that time period.

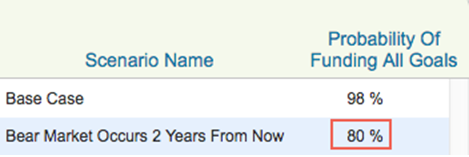

If we assume a similar bear market for them two years from now, here's what happens running the plan through the Monte Carlo simulation:

That's actually not too bad. Often a bear market can be a tremendous blow to a plan, causing its probability of success to crash by half or more. All bear markets are different, of course, but we can protect against even a drop to 80% to an extent.

Our Recommendation

The main issue we see with this portfolio is its exposure to global equity markets. Do you know the phrase "once you win the game, stop playing?" RoG has basically won the game. We would probably recommend they consider a chunk of fixed-income holdings. It need not be huge, but something.

It's no accident that the RoGs are mostly avoiding bonds. Mr. RoG has addressed the topic multiple times, saying things like (a couple of years ago), “I’m 35, and planning for 5-6 more decades of spending down my portfolio. Bonds don’t pay much more than inflation today, so I can’t justify them in my portfolio right now. Our spending is flexible enough that I could decrease living expenses if the market crashes suddenly, so I can get by on almost 100% equities (other than a 1-2 year cash reserve).”

Fair enough. He has considered the issue and decided the risk of being all in stocks is worth it--and has arguably addressed the risk with the cash reserve.

The more risk-averse FIRE practitioner, though, may be interested in seeing what a slug of bonds might do for them in case of a bear market. Just a quick back-of-the-envelope modification putting about 25% of their holdings into medium-term bonds boosts that bear-market scenario to 87%:

And They Lived Frugally Ever After

There is more than one way to make early retirement work. One critical piece is knowing what tools are available and using them when appropriate--knowing the system, inside and out. Who among us has done the Social Security deep dive (linked to above) that the RoGs have done, for example, or learned all the rules about how to get to your IRA savings early and without any penalties?

We're biased, but we think another important piece is to be vigilant about monitoring your plan--trying to poke holes in it and updating it to reflect current realities. It's important enough for any retiree; it's especially vital for those with twice as many retired years or more in front of them as most people have.

Find out how much you need to save in order to retire comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.