Key Points

- Recurring fees of any sort can be insidious.

- Mutual fund fees, especially over time, can be devastating to a plan.

- There may be ways of getting you most of what you want in your investments for a fraction of the cost.

Do you know what your investments cost?

We’re not talking about the share price, or the NAV. We’re not talking about advisor fees either, although that is another topic we have explored. We’re talking about fund fees.

Know what your fees are, and figure out what they cost you. A high expense ratio on a fund with a relatively low balance, while not great, may not affect your overall total returns all that much. That high expense ratio on investments with larger balances, though, will be problematic.

See how your funds compare with other options available. Do you really need that actively managed fund? Did you choose it yourself, or was it sold to you? If the former, maybe you were chasing the performance of a manager who had a hot hand; if the latter, maybe somebody got a nice commission for making the sale.

Reversion to the mean happens. The mean is usually the index, and the index is usually investable, and an investable index fund is usually cheap, cheap, cheap. High-flying, actively managed funds, almost without exception, won’t be able to fly high forever--and chances are very slim that you’ll be able to pick the exception. Outperforming the overall stock market for long stretches of time is nearly impossible.

So, for your actively managed funds, it probably makes sense to see if there are index-fund options that get you most of the way to what they’re doing. Don’t you mostly need the asset allocation (like value stocks, growth stocks, or long-term bonds) those funds provide?

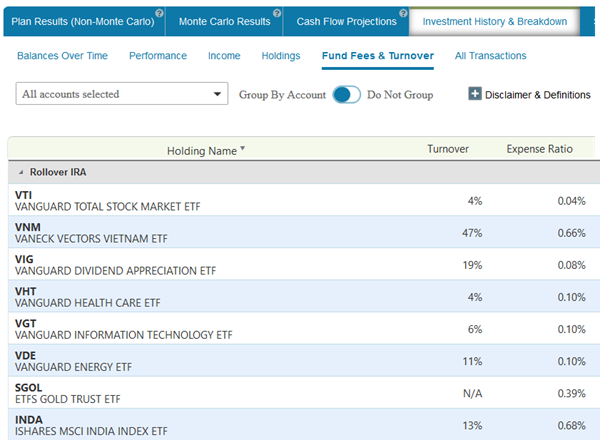

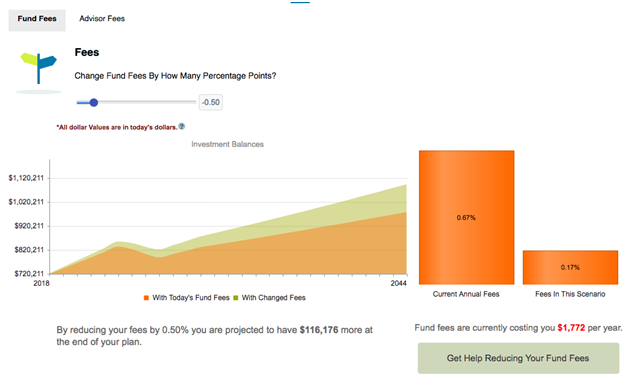

The first thing you need to do is find out what you are paying in fees for all of your funds. Thankfully, WealthTrace makes this easy as you can see in the screenshot below:

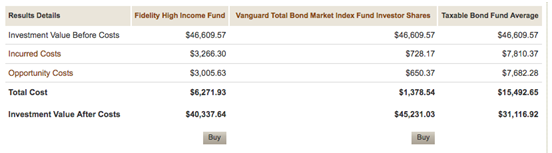

There are a number of ways to find cheaper fund options. You can talk to us, for one thing. You can also have a look at Vanguard’s Fund Cost Comparison tool. Finally, Morningstar offers a Find Similar Funds tool (subscription required) that can help you find funds similar to yours. From there, you can see if there are funds similar to yours and cheaper as well.

The Vanguard Fund Cost Comparison tool can give you a good idea about what fees can do to performance.

The results can be dramatic, especially if you’re a ways from retirement. It’s the same concept as compounding: the longer the fees are levied, the greater the effect. This will also have a big impact on how long your money will last in retirement.

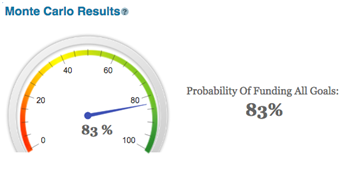

Let’s take a look at an example. Here’s a couple in their 30s doing a lot of the right things, including diligently saving what they can to tax-deferred accounts. But they’re invested in funds that, while not terribly expensive, aren’t all that cheap, either. There’s definitely room for improvement in that regard.

Their actively managed funds’ weighted average expense ratio is around 1.4%. These days, with companies like Vanguard offering funds with expense ratios of 0.4% or even closer to 0.04%, that’s just too high.

Our couple is in pretty good shape even before making any changes, with an 83% chance of funding all of their retirement goals.

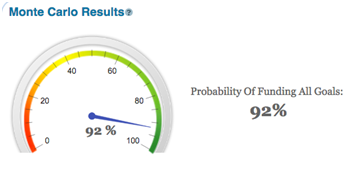

But if we bump up their total annual returns by a full percentage point, which getting them to a 0.4% expense ratio effectively does, their prospects improve dramatically.

Again, this couple is relatively far away (20+ years) from retirement, so the effect on the reduction in fees is going to make a bigger difference for them than for those closer to retirement due to compounding over time.

WealthTrace can help you get your fees down--and it could make a big difference.

Do you need to make any changes to your investments? Maybe so, maybe not, but it’s definitely worth having a look.