Key Points

- Reliable cash flow is the basis for nearly every successful retirement plan. You can use the WealthTrace Retirement Planner to generate your plan, including any pension benefits.

- A pension can be one source of such cash flow--and can really come in handy in the event of a market downturn.

- Accounting for pension income properly is critical to projecting the success of a retirement plan.

Sometimes, the main difference between a tenuous retirement plan and a solid one is the reliability of the cash flows you’re expecting in retirement.

We have written before about how dividend income can save a plan. If you can find reliable dividend payers, fluctuations in the market will matter less to you, as you may not need to draw down on your investment accounts--or draw down on them as much, anyway--just as the stock market is taking a bite out of them.

Even if you owned a diversified portfolio of strong dividend-paying stocks, a big market downturn would almost surely take your portfolio down with it (though likely to a lesser extent than the broader market). But there are stocks that have paid increasing dividends for 20, 30, even 40 years or more, through thick and thin. The dividends can help you ride out the market’s periodic storms.

It’s a similar thing with pensions. It’s cash flow, and it’s virtually guaranteed--just what every retiree is looking for. If you’re in your portfolio drawdown years and you have some flexibility in your spending, you can generally count on a pension to get you through some lean times if needed.

The Million Dollar Case

Consider a couple with a million-dollar portfolio and $60,000 a year in projected living expenses in retirement. Their portfolio is set up to generate around 4% in dividends and distributions each year (not that difficult to do, even after the market’s strong performance in recent years). So that covers $40,000 right there. A conservative 2% drawdown rate (the amount coming out of their investment account in addition to the dividends) will cover the rest of those expenses. Over time, the portfolio should grow at a faster rate than that, so they shouldn’t run out of money.

But what if they’re in the first year or two of retirement and are hit with a market correction?

WealthTrace can run your portfolio through a bear market and show you how it could affect your retirement plans. Learn more.

In a short period of time, let’s say the portfolio loses 30% of its value. Living expenses, meanwhile, definitely do not go down by 30% over the same period. That initial 2% drawdown rate now jumps to more like 3% at exactly the wrong time. They’ll be pulling out money faster and faster just as the market has taken a big bite out of the account.

Pension To The Rescue

It can be a different story, however, if one or both of the plan participants have a pension.

Pensions are less common than they used to be, but can make a big difference during the lean years of a retirement plan.

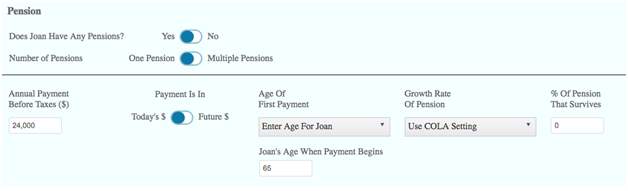

In this example, one person in the couple is projected to have $24,000 coming in via a pension--about what the couple would need to cover that 2% portfolio drawdown. Instead of pulling out portfolio principal when the market corrects, they can rely on the income from the pension.

Things To Consider With A Pension

WealthTrace can help you drill down into a retirement plan that accounts for pension income. You’ll want to know a few things before you get started inputting the information:

- When does the payout start? Similar to Social Security, you might have some say about this (and the sooner you start to take the payments, the less it will be each year).

- How much will the payout be to start with? See previous item--one likely depends on the other.

- At what rate will the pension benefit grow (if it grows at all)? Sometimes pensions are indexed to inflation, sometimes not.

- How much, if any, of the pension will continue to be paid out to the surviving spouse? Most likely, at least some portion of it will be paid out--the survivor’s benefit--in the event that the pensioner dies before his or her spouse does.

- Is there a chance the pension will be reduced, or even disappear? This is a tricky one, and painful to contemplate. But industry landscapes change; pension funding projections can be too optimistic; the future is unknowable. It might make sense to trim back projected pension benefits a bit just to be conservative when putting your plan together.

Most retirees will take cash flows any way they can get them, but pensions are among the best ways. Count yourself fortunate if you have one--and make sure to account for it properly when putting your retirement plan together.

There is a lot more to a successful retirement plan than just hitting a number. You’ll want to WealthTrace covers all the bases. Learn more.