Key Points

- It's great to start with a big-picture goal like saving $1 million, but you'll need a strategy to get there.

- Closely watching expenses in the first years of early retirement is critical.

- Flexibility is also key to retiring early on a modest budget.

People approach retirement planning in a number of ways. Sometimes a retirement plan starts with a single, high-level goal. "I want to retire with $1 million," for example, or (and this is a better way of thinking about it), "I want to retire with enough money invested that will generate $75,000 a year."

Approaching retirement like this leaves the details for later. That's fine, but at some point, the details will need to be filled in. It's only once you have the details that the plan really starts to take shape. Goals--financial or otherwise--require a strategy to make them happen.

Let's go back to the $1 million figure. It's a number that feels like a lot of money (even though it's not, necessarily) to a lot of people. People tend to anchor on this number.

What has to happen for a 55-year-old couple to be able to retire with $1 million? We'll walk through the steps, starting with the getting-to-a-million-bucks part.

Where Can I Find A Million Dollars?

The first thing you'll want to make sure you're doing is contributing to your 401(k) (assuming you have one). How close can you get to contributing as much as is allowed by law? It could be tough to squirrel away the maximum $18,000 (or $24,000 if you're 50 or older) if you're making, say, $50,000 a year, though there are people who manage to do it. If that's not possible, make a habit of increasing your contributions a certain percent every year. You could also vow to take half of any salary increases or bonuses and funnel them into deferred compensation. Regardless of how much you're able to sock away, for many people, a 401(k) is the best way to start the march to a million bucks.

-contributions.png?sfvrsn=0)

WealthTrace can import your 401(k) account holdings and help you track your progress toward retirement.

The Spending Part

Let's say you're nearing $1 million in invested assets as you approach your 55th birthday, and you're wondering how soon you might be able to retire.

If you are at this stage--at a point where you are seriously thinking retirement could be near--it's mainly going to come down to spending. The asset accumulation phase is winding down. You'll probably have to make some adjustments to your investments' asset allocation if you haven't already. But the big question now is, how much do you need to live on?

Here's a simplified example. A couple nearing 55 years old with a single taxable joint brokerage account worth about $1 million and no debts is thinking about saying goodbye to full-time employment. They want to know what they need to do to make it work.

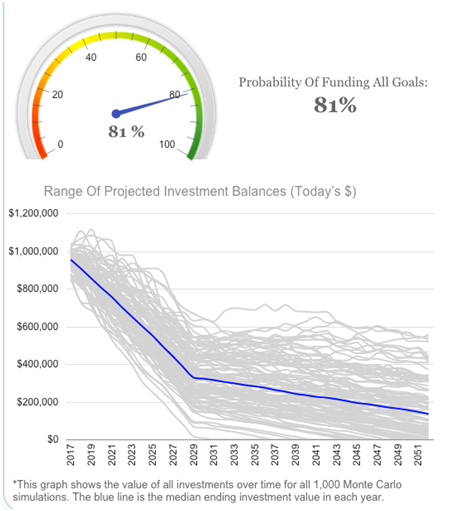

If I run their case through WealthTrace with a bare-bones (according to the couple) $50,000 in annual spending, the Monte Carlo results look like this:

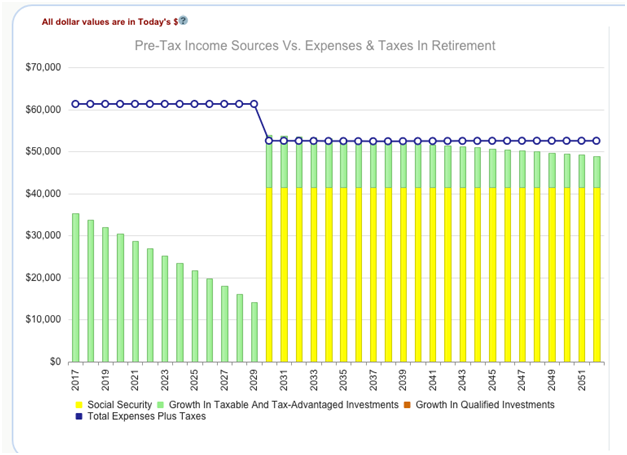

That's an 81% chance of making the plan work with a 90-year life expectancy. On the non-Monte Carlo side, the income versus expenses graph looks like this:

What's happening here? Well, in short, the couple draws down on a big chunk of that account during the first 13 years or so, before Social Security kicks in in 2030. During those first years, income sources don't even come close to covering their expenses. After that, Social Security is projected to make up the lion's share of their income (which is why the taxable account no longer loses value so quickly).

If this couple came to me and asked for some advice, I would point out a few things. First, 81% is a bit low on a Monte Carlo projection. Mainly, though, I don't like how income barely covers expenses once they start taking Social Security. There's nothing inherently wrong with income sources not covering expenses some years, especially in retirement. But in this case, income sources almost never cover expenses; with 35 years or so to go, it leaves too much to chance.

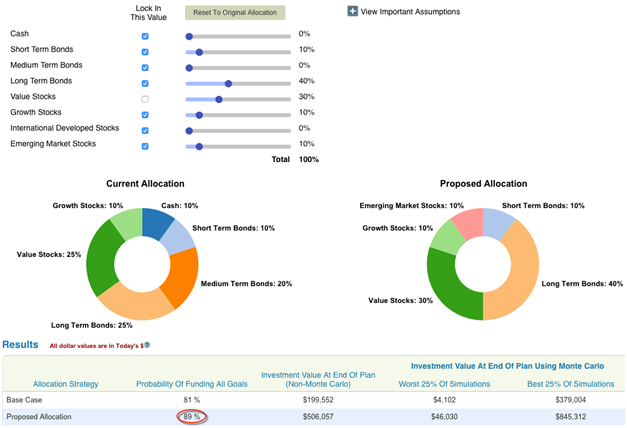

A few changes to the couple's asset allocation bumps their probability of success up several percentage points . . .

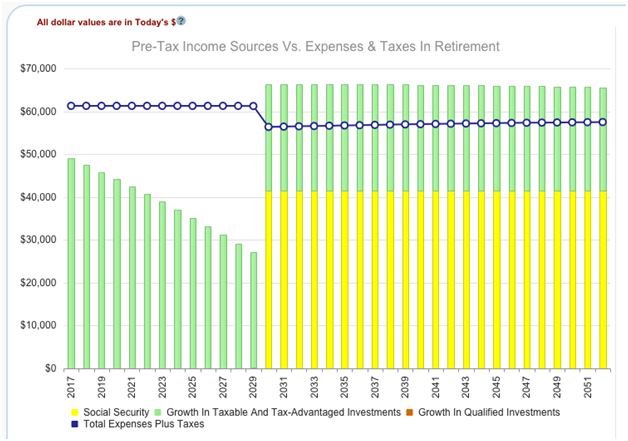

. . . and it also helps their income sources cover their expenses much more comfortably once Social Security kicks in:

That looks a lot better. To pad it further, I might also recommend a phased retirement or some part-time work for a few years--even just five or so years at the start would smooth things out.

Give And Take Pays Off

This is not a slam-dunk plan, but it can definitely work. The more flexibility a potential early retiree has, the easier it is. Having no debt, a willingness to work part time, and the ability to adjust spending downward in lean years for the stock market can make early retirement possible on a budget. (And, yes, boom years for the market can mean a splurge or two.)

There is a lot more to a successful retirement plan than just hitting your number. WealthTrace covers all the bases. Learn more.