Key Points

- Know what your normal, day-to-day spending is before setting big retirement goals.

- It's OK to start big in setting retirement goals, but expect that some compromise will be necessary.

- Get a plan and your goals in place, but revisit them regularly, as priorities change.

What are your goals for retirement?

If you ask that question of a person for whom retirement is still a distant dream, you might get an answer that is vague and dreamlike as well. They might talk of sunny beaches or golf or hammocks, and not get too much past that.

To get retirement right, you'll have to move beyond the dream stage. This means thinking about what will really be important and meaningful to you in retirement--and what it will cost.

A budget is a good place to start. We have written before about budgeting. As we said then, not everyone needs a budget (though certainly more people need them than use them), but even if you don't need one, a budget--or, if you don't like the "B" word, call it a "spending tracker"--can be very helpful in the years leading up to retirement to see where your money is going. There are a number of online tools that can help with tracking spending automatically.

Enough To Get By

Specifically, you need to know how much of your income is going toward what you live on day to day. This will include the usual stuff, such as food, shelter, utilities, and health care. When putting together a retirement plan, these items are normally assumed to be more or less fixed, and thus should not need much prioritization. You need them all.

There will be more grey-area items as well--things you use or do on a regular basis, but that you might think of as being somewhere between a need and a want. Clothing, for example, is going to lean more toward the "need" column, with spending at restaurants leaning more toward the "want" column, but both are somewhere in between. A budget (or spending tracker) should help you get those costs estimated pretty quickly.

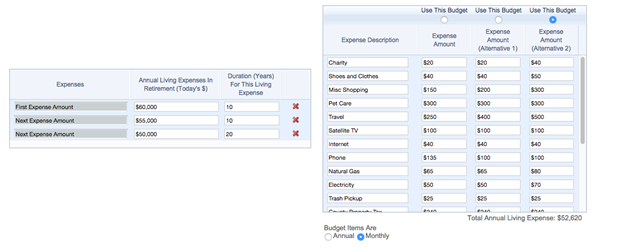

With the WealthTrace Planner, you can enter living expenses in retirement as either a single annual expense that can change annually, or as a full line-by-line budget.

With the WealthTrace Planner, you can enter living expenses in retirement as either a single annual expense that can change annually, or as a full line-by-line budget.

Get Your Priorities In Order

After putting the basics together, you can move on to the beaches-and-hammocks part. In WealthTrace, we refer to these as "Goals & Additional Expenses."

If you're close to retirement, or even if you're not, you have probably given these items some thought already. They might include

• Travel

• A winter home

• A new car every several years

• College funding for grandchildren

• Inheritance for heirs or a charitable endowment

It doesn't hurt to dream big with your retirement goals, as long as you are willing to prioritize--and to accept that you may not be able to hit all of those goals without some changes to your saving or spending habits.

Let's take a look at an example. A couple that's around 50 is starting to think about retiring early--not immediately, but in 10-12 years, with some part-time work in their early retirement years. They have done the due diligence on their current spending habits, and feel like they have a good idea of what they might spend in retirement on a day-to-day basis.

So now, they're thinking about bigger-picture goals. How do they want to spend their time? And, very much relatedly, what do they want to spend their money on?

Whittling It Down

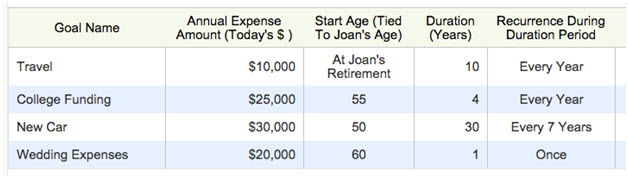

With about $900,000 in savings and investments allocated in a way they are comfortable with, no mortgage, and day-to-day spending in the range of $57,000 annually, they've come up with a list of goals for their retirement that looks like this:

WealthTrace allows you to account for retirement goals in addition to day-to-day spending.

WealthTrace allows you to account for retirement goals in addition to day-to-day spending.

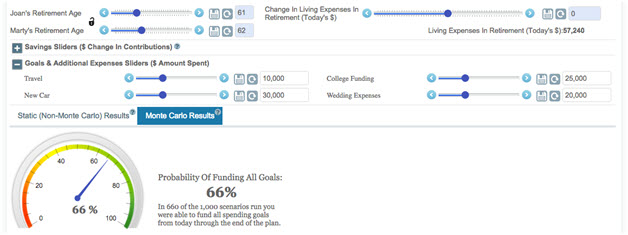

Putting the plan through WealthTrace's Monte Carlo simulation (see our piece about using an accurate Monte Carlo simulation here), the results look like this:

A 66% chance of funding all of their retirement goals isn't bad, but they would like to see it a bit higher.

They have a number of ways to make that happen. In the picture above, they are able to adjust a number of variables, including retirement age, living expenses in retirement, savings rates, and the cost of their goals and expenses in retirement.

The couple is not interested in delaying their retirement at all, they're saving all they think they can save, and they're pretty confident that their living expenses in retirement (the $57,240) can't get much lower.

That leaves the retirement goals. Remember the needs and wants discussion earlier? All of the retirement goals are wants, really. So it's a matter of prioritizing them.

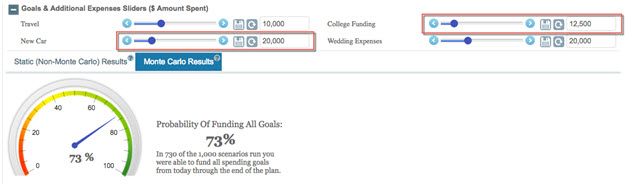

The college funding is a pretty big expense--$25,000 a year for four years. Let's see what happens if they cut that in half, and cut back on the anticipated cost of a new car every several years by 1/3:

WealthTrace allows you to make adjustments to a plan on the fly.

Here's what the numbers look like after dialing back the college funding and new car expenses:

The couple is a lot more comfortable with a probability rate above 70%. (Sorry, grandkids, you may have to take out a bigger college loan--Grandma and Grandpa love you but aren't going to give up their travel plans for you!)

Sticking With The Plan

A successful retirement plan, as we've said before, comes down to using the levers you have available to you: saving, spending, investment decisions, and, what we're talking about here, prioritization. Priorities change, of course. It's best to set up a plan you're comfortable with, but revisit it on a regular basis and modify it as your priorities change to ensure maximum hammock time.

Have you thought about your retirement goals? What kind of return to expect from your investments? The effect of taxes and inflation on your savings? Sign up for a free trial of WealthTrace to find out if your retirement plans are on track.