Key Points

- If you want to retire early, it's best to start thinking about it when you're young. But that's not the only way.

- There are a number of ways to make early retirement happen, especially if you save consistently.

- Using WealthTrace, you can run what-if scenarios (what if I save more; what if I spend less; what if I invest more aggressively; and many others) that can show you what would have the most impact on early retirement plans.

How can you retire at 50? Reading this blog post when you're in your 20s would be a good start. That's because the earlier you get started planning (and saving, and not spending) for retirement, the better chance of success you'll have--and the better chance you'll be able to retire early.

But the age at which you are reading this article is not something you have a lot of control over. So we'll help you with the things you do have control over.

Starting Young

If you do happen to be reading this in your early 20s, congratulations. Even being interested in this stuff puts you light years ahead of most of your peers.

At this age, you have lots of ways to make retirement at 50 happen for you. You can:

- Spend less money

- Make more money (find a new job)

- Save more money

- Invest more money (and more aggressively)

- Plan on some part-time work after 'retirement'

. . . or some combination of these.

Let's say you start planning for retirement at age 22. Obviously lots can and will happen between ages 22 and 50, but let's make a few assumptions for our hypothetical young retiree.

We're going to assume she is starting out in the workforce with a $70,000 annual salary. She'll take $13,000 of that and contribute to a 401(k) and an IRA, all of it in growth stocks. And her employer will match the 401(k) contributions dollar for dollar up to 10% of her salary. (That's free money! Read our article about maxing out contributions to your 401(k) and average 401(k) balances by age for more info.) And when age 50 rolls around, we'll assume she'll be able to live on $55,000 per year (in today's dollars).

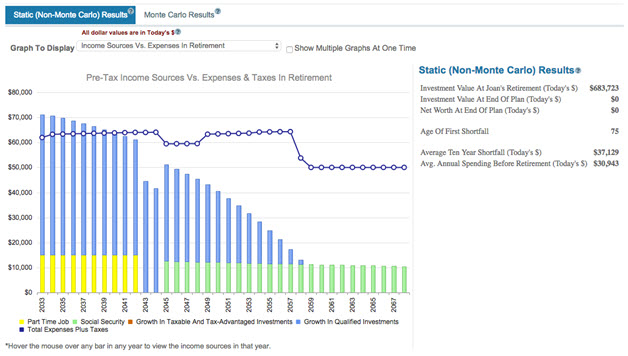

How do things look? Not too bad, actually. Assuming static, consistent returns--certainly not the only thing one should look at when putting a plan together, but a starting point--our subject will have more than $1 million in today's dollars when she gets to 50:

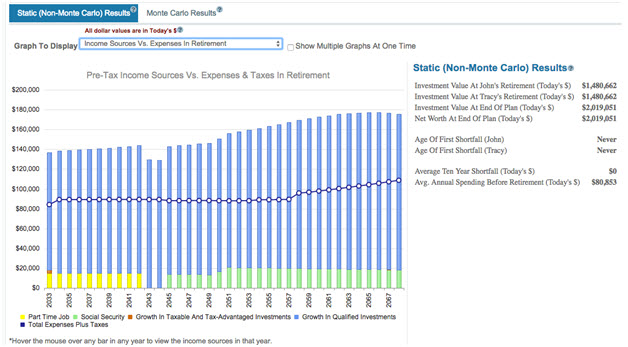

WealthTrace includes graphs like this one to help you visualize income versus spending in retirement, and whether you're on track to meet your goals.

WealthTrace includes graphs like this one to help you visualize income versus spending in retirement, and whether you're on track to meet your goals.

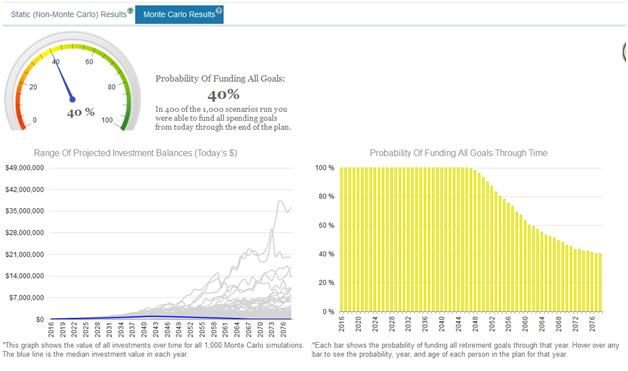

But if we start running Monte Carlo simulations on this plan, things don't look as good, with only a 40% chance of success of funding all goals:

WealthTrace shows you probability of plan success via professional-grade Monte Carlo market return simulations.

Since (very early) retirement is still 28 years away, there's a lot this person could do to bump that number up. For example, if she can manage to save $16,000 instead of $12,000, WealthTrace tells us that probability jumps to about 50%:

WealthTrace allows you to make changes to your plan right on the screen, so you can see what-if results in real time.

WealthTrace allows you to make changes to your plan right on the screen, so you can see what-if results in real time.

Add to that a $11,000 per year part-time job for the first 10 years of retirement, and now we're at a 55% probability of success.

Add non-investment cash inflows like a part-time job to WealthTrace to see what effect they might have on your plan.

Saving $16,000 per year on a $55,000 annual salary. Can it be done? We would say yes (you're young--get another roommate!), but it's just one way to do it. Making other tweaks to the items in the bulleted list above could make it work too.

Starting at 32

Once you're into your 30s, you're probably at least thinking about a family, maybe buying a house or a condo, plotting a career. Different things become important to you. Retirement may be coming into clearer focus.

Let's assume we have another relatively young worker who has also just started to get religion about saving for a possibly early retirement. He's 32 and making $70,000 per year.

Since he's getting started later than what's ideal, he's going to need to put away a larger percentage of his salary to get even close to retiring at 50. Let's call it $50,000--$20,000 into a 401(k), and $5,000 into an IRA--with the same free-money 401(k) match that we have in the case above. We'll also say he's managed to build up a $22,000 balance in a taxable brokerage account that he's going to move into mostly growth-stock mutual funds--the same as his 401(k) and IRA.

In this case, it's going to be too little, too late. Even if we tack on a part-time job for 10 years, he's going to come up short:

Even with a part-time job for the first 10 years, our early retiree will likely run out of money.

But all hope is not lost. For one, he's still pretty young, and has a number of levers he can pull to get to early retirement (saving, spending, investing, pushing that retirement age out a bit, and so on).

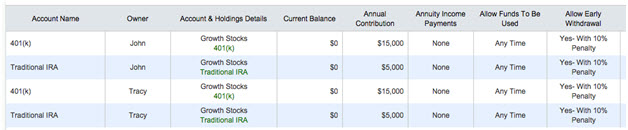

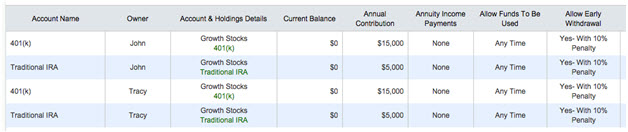

Now let's assume Mr. 32 has gotten married, and that Mrs. 32 is bringing home the same salary and making the same contributions. We'll bump their projected living expenses in retirement up by 50%, to $78,000. Here's what their retirement contributions look like now:

Note the "Allow Early Withdrawal" column. WealthTrace allows you get to your retirement money early for the purpose of making projections--a big help for would-be early retirees.

So how do things look?

That's more like it! And the Monte Carlo results put their probability of success at more than 50%. A few tweaks here, some belt-tightening there, and this couple could probably get that probability in the 75% range.

Ways To Make It Happen

Your situation will not mimic either of these exactly, of course. We haven't even touched on planning for kids and their education funding, or even our young retirees' student loan debt, or a mortgage. But the point is to show that early retirement is attainable in a number of ways, especially if you start thinking about it early in your career.

Do you know what to expect to spend in retirement? What kind of return to expect from your investments? The effect of taxes and inflation on your savings? Sign up for a free trial of WealthTrace to find out if your retirement plans are on track.