I recently had a prospective client come to me with an interesting case. He and his wife have $800,000 saved, half of which is in an IRA. He and his wife are both currently 45 years old. They want to retire by age 58 and they never want to worry about the principal. They only want to live off of dividends and/or interest income.

With interest rates so low I already knew that this couple was in trouble because 25% of their money was in treasuries. So I took them through my analysis, starting with their current portfolio.

Let’s start with their current portfolio and some assumptions:

| Inflation (CPI) | 2.5% |

| Current Age of Both People | 45 |

| Age Of Retirement | 58 |

| Age When Both People Have Passed Away | 85 |

| Social Security at age 67 (combined) | $40,000 per year |

| Average Savings Rate | $10,000 per year |

| Total Investment Balance Today | $800,000 (50% in Taxable, 50% in IRAs) |

| Recurring Annual Expenses in Retirement | $70,000 |

| Investment Mix | 75% Mixed Equities,

25% Medium Term Treasuries |

| Return Assumption Of Equities | 7% per year |

| Dividend Yield OfEquities | 1.5% |

| Dividend Growth Rate Of Equities | 5% per year |

| Return Assumption Treasuries | 3% per year |

Before generating a retirement plan for this couple the first thing we need to clear up is, what constitutes success? In this case we want to ensure that this couple does not dip into principal. So we will be looking at their income vs. their expenses and we will be seeing if they do indeed dip into principal.

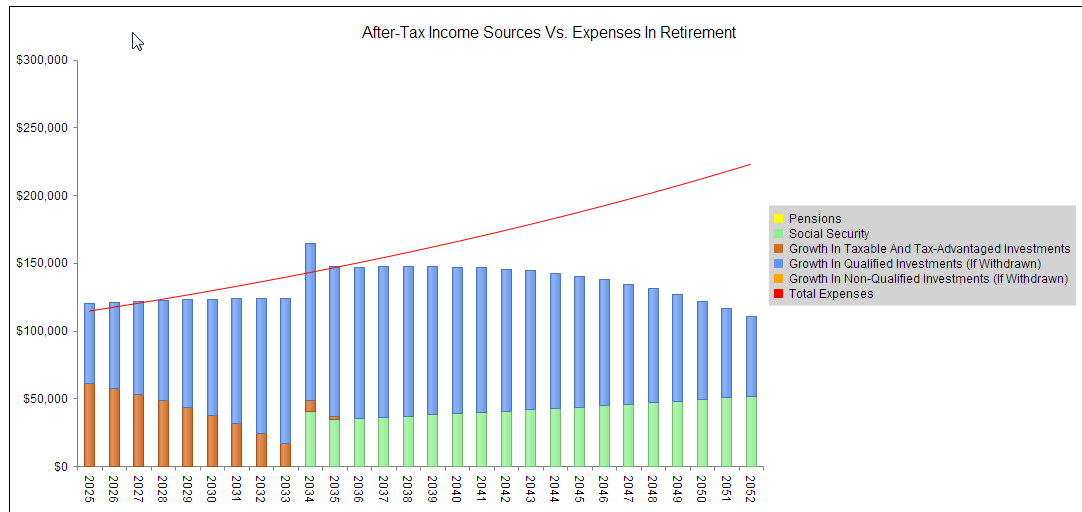

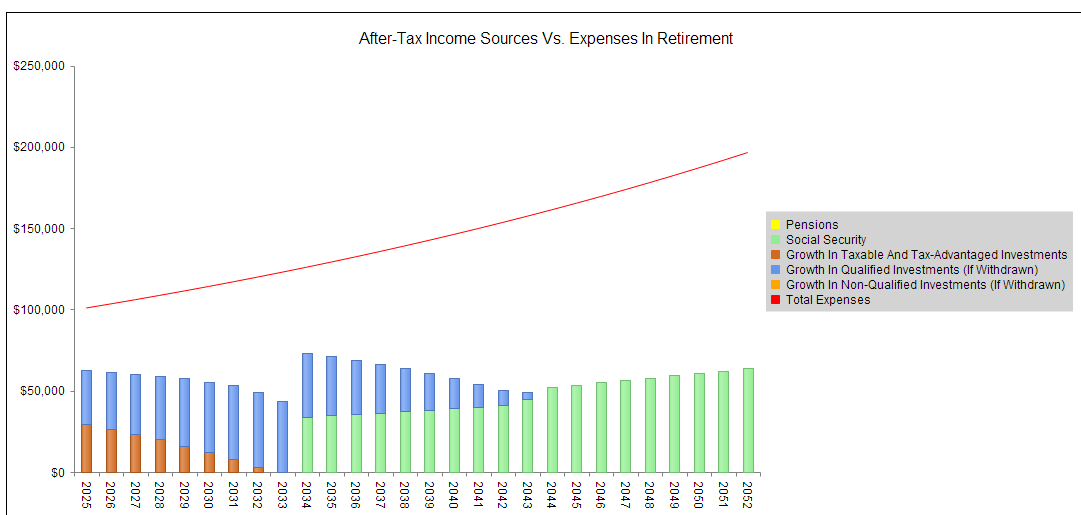

Using our retirement planner I ran the analysis. Below we see their income sources vs. their expenses through time.

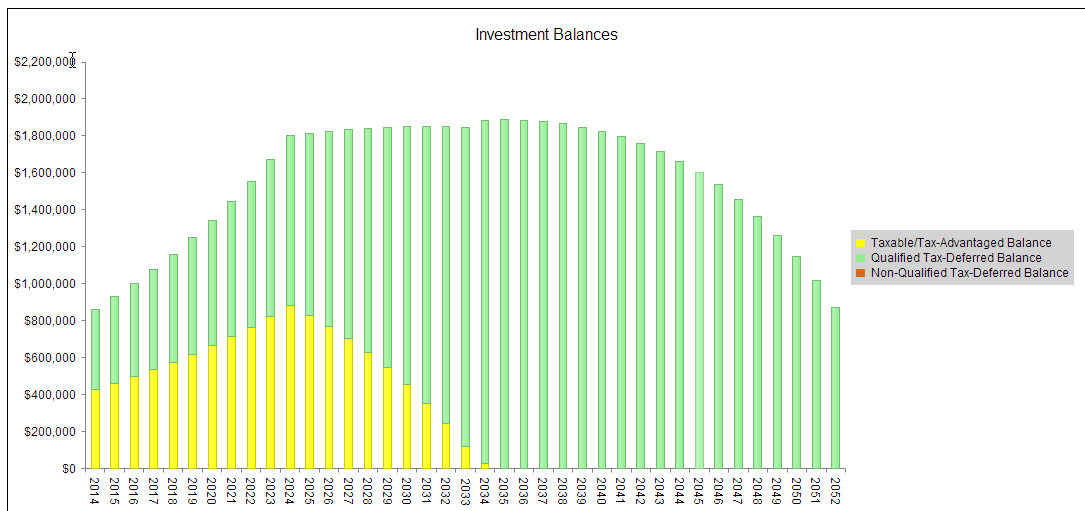

You can see that in most years their income is not sufficient to cover their expenses. This is because they are reliant on some treasury income and capital gains from their equities. We can also see in the graph below how their investment principal begins to decline.

I then posed the question: What if we move all of their money into solid dividend-growth stocks where they will only be living off of the dividends and that is it. Principal will never come into play. To start I assumed we could find strong dividend payers that have consistently raised their dividends over the years. A few of my favorites are Johnson & Johnson (JNJ), Sysco (SYY), AT&T (T), Wal-Mart (WMT), Coca-Cola (KO), and Eli Lilly (LLY).

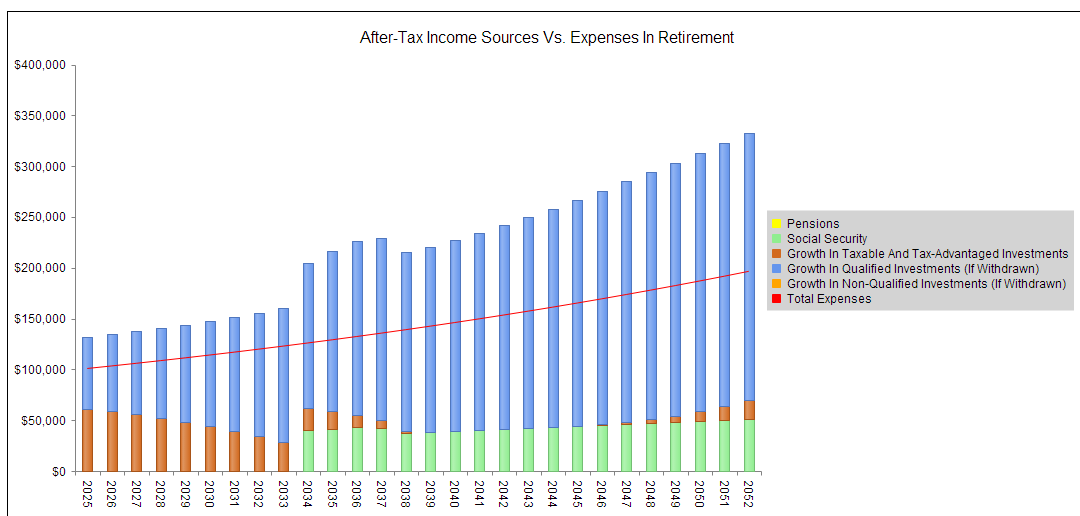

My starting assumption is that this basket of DG equities would have an average dividend yield of 2.5% and an average dividend growth rate of 10%. The results for their income vs. expenses is below:

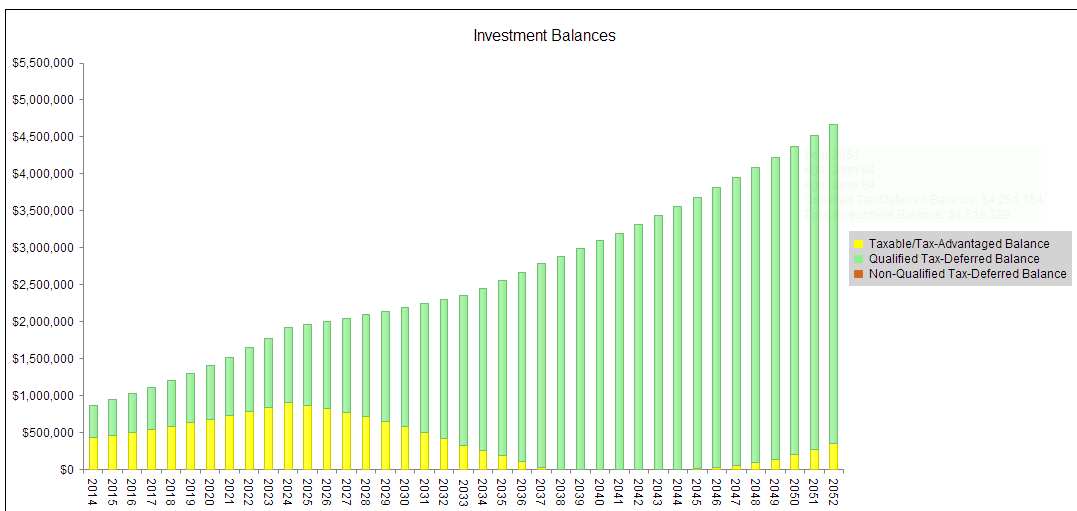

We can see that expenses are covered by dividend income in every year. We can also see in the graph below that their principal balance never declines.

It is of course a very valid question to ask, what if the dividend growth isn't 10%? What if it is 5%? Let's take a look at what this does.

This is clearly a problem if they want to live off of income only. It shows vividly how important our dividend growth assumptions are. It also shows how important it is to find companies that you believe will consistently grow their dividends over time.

To be conservative we assumed that their DG stocks would indeed only grow their dividends by 5% per year. From there we tweaked their plan and changed their retirement age to 62. They also agreed to cut back on some spending in retirement so that their recurring expenses would be $65,000. This did the trick as all expenses were now covered by dividends even with the 5% dividend growth rate.

Each person and couple has a different situation and might need to change a variety of things in order to meet their retirement goals. But it is usually impossible to tell whether or not you can retire when you want until you sit down and actually run through the numbers. At that point you can begin running interesting scenarios that will tell you what you need to do to get to your goals.