Bond yields have finally starting moving up as the Federal Reserve has begun hinting that they might reduce the amount of bonds they have been buying. The ten year treasury yield is now at 2.12%, which is nearly 0.50% higher than we saw a year ago. Of course, we have a long way to go to reach the 5% level we saw in 2007.

Low interest rates over the past five years have undoubtedly hurt those in retirement who wanted to live on a fixed income. In fact, it completely ruined many retirement plans and forced some people back to work. Now that rates have risen slightly I want to take a look at how continued rising interest rates might impact a couple who wants to primarily live on the coupon payments from treasury bonds.

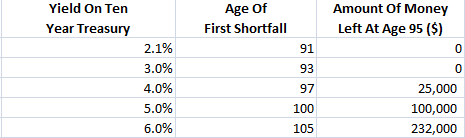

Let’s take a look at how the world has changed for those in retirement and invested 100% in treasury bonds. I ran the following in our retirement planner. I took a couple that is 65 years old, has $500,000 in investable assets (all in IRA funds), they’re invested 100% in 10 year treasury bonds, they will receive $30,000 per year in social security benefits, and they spend $45,000 per year. I also assumed 2.5% inflation and that they both live to age 95. I wanted to see if and when this couple runs out of money in retirement today vs. five years ago when ten year treasury bond yields were 5%.

At today’s interest rates this couple will run out of money when they are 91 years old. This is way too close for comfort for anybody’s retirement plan, especially since I did not even include any buffer for unexpected expenses. We see that if yields moved back to 5%, where they were six years ago, this couple would not run out of funds until they are 100, which gives them much more room for unexpected expenses in their lives. And if yields on the ten year treasury were 6%, this couple would pretty much have it made in retirement as their funds would last until they are 105 years old.

Unfortunately, it doesn’t really help to talk about how much better off so many retirees would be if interest rates were higher. This is the world we live in today. The question is, what can they do about it? What if their goal was to have their funds in retirement last until at least age 100? I ran some what-if scenarios and found a couple of ways they can do this: 1) They can cut spending by $6,000 per year or 2) They can work part-time for $30,000 per year for 15 years. Neither of these options sounds too enticing to most people.

Another goal they may have is to end their plan with at least $50,000 that is a safety buffer in case of higher expenses. Currently they cannot accomplish this by being 100% in treasuries. But what if they moved 1/3 of their funds into dividend growth stocks that have a history of paying and growing dividends over time?

I generally only recommend and invest in companies which have a dividend yield above 2% and a long history of increasing their dividends over time, even in recessions. Three of my favorites that meet these criteria are Johnson & Johnson (JNJ), Coca-Cola (KO), Intel (INTC), and Wal-Mart (WMT).

| Company | Div. Yield | 5 Year Div.

Growth Rate |

| JNJ | 3.0% | 8.2% |

| KO | 2.7% | 8.4% |

| INTC | 3.8% | 14.1% |

| WMT | 2.4% | 12.6% |

If we take 1/3 of this couple’s money that is currently in treasury bonds and place it in a basket of solid dividend payers that yield 3% and average 7% for their dividend growth over the next 30 years, how would this change things for them? It turns out that at age 95 they would have about $10,000 left. If we move half of their money into the dividend payers they would have $48,000 left.

What this analysis shows is that a) it is incredibly important that you can beat inflation over time and b) the power of growing dividends over time can change a retirement plan immensely. It is sad that so many in retirement have to deal with interest rates that are below inflation. But that doesn’t mean there aren’t other options.